Are you wanting to sell your Minnesota house but still have a mortgage to pay? Read this guide to make the process clearer and help you with this move.

If you need to sell your home but still have a mortgage, you may be wondering if selling a house with a mortgage in MN is even possible. The truth is simple. Most people who sell homes today have mortgages on their homes.

Think about it, the average home mortgage is for 30 years. But most people only live in their homes for around 13 years. Needs change. Relocations happen. Family dynamics evolve over time. Whether you are facing an empty nest, a growing family, or you’re bringing an aging parent into your home, you may find yourself needing to sell your house long before you’re finished paying for it.

That doesn’t mean that everyone who has a mortgage is able to sell their home, however. This guide will help you understand what it takes to sell a house if you have an existing mortgage in today’s real estate marketplace. Here’s what you need to know.

What Happens to Your Mortgage When You Sell Your House?

The goal, when selling a house with a mortgage in MN is to sell your home for more than what you owe on the mortgage. This means you’ll have money left over after the sale of your home that you can invest into your next home – or spend as you see fit. It doesn’t have to be a challenge to sell a house if you have a mortgage. In fact, it shouldn’t offer a stumbling block in most cases.

At this time, real estate is a hot commodity and homes are flying off the market at lightning-fast speeds as buyers snap them up. In the best-case scenario, you will sell your home above the asking price as prospective buyers vie to be the ones to make the best offer and secure the sale of the home.

The money from the sale of your home goes first to pay off any remaining balance on your mortgage. The lender is going to get its cut before you take anything else off the top. The next step is to pay off any home equity loans or HELOCs you have. Those are the first two priorities for the cash proceeds when selling your home.

Then, you must cover your portion of the closing costs when you sell your house. Your mortgage will have closing costs when you buy the home as well as when you sell it. It’s the rules of the road when it comes to real estate and can make a huge difference when it comes to what is the best possible price for you to get for the sale of your home.

The funds that remain are yours. That means you can use those funds as a down payment on a new home for you, to pay off other debts, or to buy an RV and travel the country if that is what you wish to do with your money after you sell your home and getting rid of your mortgage.

Understanding How Much You Owe

One thing many people misunderstand is that the amount of money required to pay off your mortgage will be a little less than if you continued making monthly payments on your house for the remainder of your loan terms. The reason for this is that you are (hopefully) eliminating interest payments when you pay off your mortgage early. The further you are into your 15, 20, or 30-year term, the less you save by paying your mortgage off early. The earlier into the term, the more money you will save on interest when selling a property and paying it off early.

You can find out exactly how much your payoff amount is by contacting your mortgage company directly and asking for it. It’s also a good idea to make sure your mortgage doesn’t have penalties for early payments or pay-offs on the property. These can prove costly and may eliminate the potential benefit of selling your house.

When you know how much you owe on your mortgage, you can make informed decisions about the asking price that meet your needs for repaying your mortgage and for pricing your home aggressively when selling a house with a mortgage in MN. Keep in mind, though, that in areas like the Twin Cities, the housing market is booming with U.S. News reporting in May 2021 that the median cost of a new home had risen $4,000 for three consecutive months. Price accordingly.

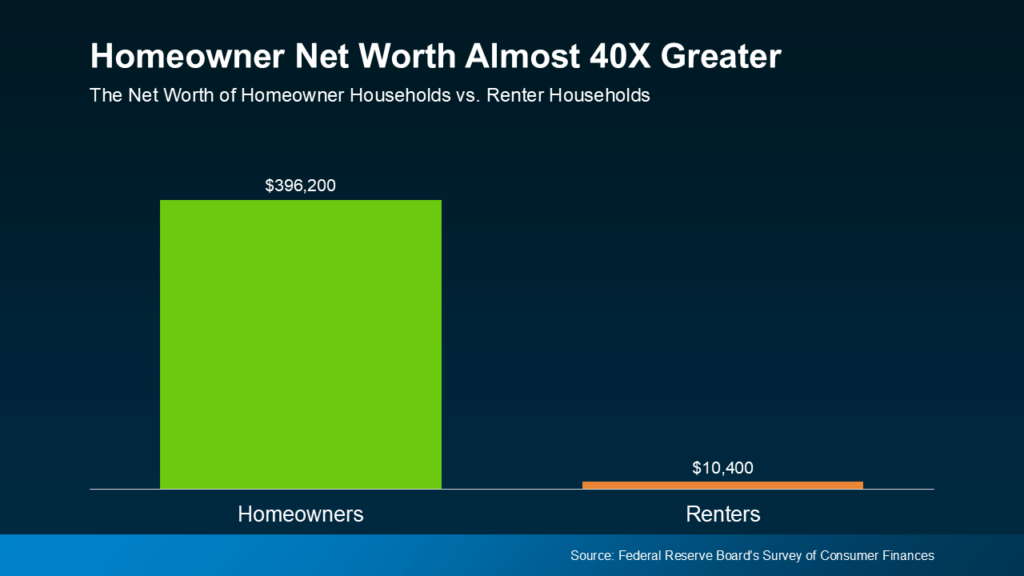

What is Equity, and How Can it Help?

When it comes to buying a home, equity is the term for the difference between what you owe on your home and what the home is currently worth. For instance, if you owe $248,000 on your mortgage and the borrowed amount for the home is $316,000, then you would subtract the amount you owe from the borrowed amount to determine your equity.

$316,000 – $248,000 = $68,000

Can equity help you when selling your house? In addition to paying a portion of the closing costs, you may also be responsible for agent fees (if you are the buyer are working with a real estate agent), taxes, and other fees associated with the sale.

Ultimately, the goal is to leave the closing table with tens of thousands of dollars to your credit to help you secure home loans in the future or to ensure that you can pay cash for your next real estate purchase. The good news is that housing prices in MN are on the rise. This improves the odds you’ll have some positive equity in your home when closing.

Why the Current Property Value Matters

One of the more important things to understand when selling a house with a mortgage in MN is the importance of setting a price for your home to sell based on the property value in today’s dollars. Not only does the value of real estate fluctuate over time, going up and down according to the laws of supply and demand. So does the value of money.

There are many mitigating factors that affect the “current home value” of your house. You need to know what that is when you go to sell your house and how to show your home to maximize its potential. Everyone would love to get your home into a bidding war when it’s time to sell. That isn’t necessarily the case, for the buyer.

When you list your home for sale, knowing the current property value allows you to price your home attractively to people looking to buy if you’re hoping for a fast sell. However, if you would prefer to make more money from the sale of your home, you can price it a little more aggressively in hopes of igniting a bidding war. You always have the option of reducing the price later. Though there are risks in that decision as well as some people might wonder what is wrong with your home.

That is why it is so important to price your home appropriately when attempting to sell. Especially if you’re trying to sell your home with a mortgage in MN. The easiest way to understand the property’s worth now is to have an appraisal conducted on your home. While most prospective buyers will do the same, this appraisal is for your information and can help you when dealing with your mortgage company as well as selling your real estate property faster in an already hot Minnesota real estate marketplace.

Selling a Home With a Home Equity Line of Credit (HELOC)

HELOCs, or home equity lines of credit can be highly beneficial to homeowners who have a few additional expenses they’d like to pay without charging up high-interest credit card debt to do so. Perhaps your goal is to pay off your existing credit card debt at a much lower rate.

You’re essentially cashing out some or all of the equity in your home in order to obtain the loan. This loan can then be used for whatever needs you may have. If you want to sell a house that has a HELOC in addition to the standard mortgage agreement, you may need to do a few careful calculations to make sure you do not owe more on the home than it is likely to sell for. This can happen if your HELOC is recent, and you haven’t had time to pay down some of the interest on the loan and your line of credit. And that doesn’t even include agent fees, closing costs, and other fees you may experience when selling your home.

The bottom line is that the more equity you have in your home, the better it is for your financial situation when selling a home with a mortgage in MN.

The Pros and Cons of Selling a Home With a Mortgage

When it comes to selling a home with a mortgage in MN there are pros and cons to keep in mind. The pros and cons may change according to certain conditions, such as having a HELOC, having too little equity in the home, etc. This is what you need to know to make wiser choices.

Pros of Selling Homes with Mortgages

- You’re done with your mortgage. At least on this home.

- You’ve eliminated some of the interest in the home purchase.

- You’re now free to purchase another home or make a move your family desires.

Cons of Selling Homes with Mortgages

- You may face penalties for early loan payoff. Read the fine print and compare options when securing your next mortgage to avoid this situation.

- A HELOC or too little equity in the home can derail your efforts.

- Real estate loans almost always cost more than you bargained for.

Of course, if you need to sell your home, you need to sell your home. Sometimes, that means making hard choices. For the time being, housing inventory in Minnesota is low despite soaring demand and increased sales. That’s good news for you if you need to sell now.

What if You’re “Underwater” on Your Mortgage?

In real estate, the term “underwater” means you owe more on the mortgage for your home than the current appraised value of the home. It was a huge problem after the Great Recession with many homeowners finding they’d been paying loans for years while building “negative equity” in their homes.

Other people had obtained mortgages too recently when the market crashed leaving them with loans they were struggling to pay and no viable means of relieving the debts.

In situations like this, when you need to move and get out from under the weight of a mortgage you can’t pay, especially if you’re relocating for work and can’t sell your home for what you owe on it, lenders may consider a short sale. These loans are not ideal for lenders but if you’re at risk of foreclosure or falling behind on your payments, your lender may consider the short sale option.

It is worth noting that a short sale does damage your credit (admittedly not as much as foreclosure or bankruptcy would) but can make it difficult for you to buy, or even rent, another home. Also, it means you’ll owe money at the closing table that will have to come out of pocket and that you’ll get nothing from the sale of your home.

Receive a Real Cash Offer in Less than 48 Hours

At Home Offer Guys, we take the time to explain how our cash offer process works. Our goal is to provide a fair market cash offer that makes sense. We base our cash offer on a true, MLS-generated market valuation.

Other Considerations

If the reason you’re hoping to sell your home with a mortgage in MN involves your financial situation, there are other options to consider that do not involve selling your home. This includes things like a home equity line of credit, or HELOC, where you put the equity in your home to work for you by paying off high-interest credit cards, medical bills, etc.

Another option is to refinance your home. With some lenders, you may even be able to negotiate for lower monthly payments, extended loan terms, and lower interest rates to help you remain in your home and reduce your risk of foreclosure.

Other options that involve you remaining in your home and paying it off include getting a roommate to split the costs, taking in multiple boarders (especially good for empty nesters), and renting out rooms in your home through Airbnb. This allows you to put your home to work for you and may help you pay off your mortgage early without worries about selling your home with a mortgage in MN.

TheMLSonline

The MLSOnline is Minnesota’s leading resource for buying and selling homes. Whether you’re selling your house with a mortgage, looking for your dream home, or simply trying to get the best offer possible when you sell your house, we can help.

Real estate feels like such a big mystery to buyers and sellers alike. After all, it’s not every day that you buy or sell your home. Let our helpful resource help you make your perfect match whether you’re buying or selling your home today!

Ready To Sell?

TheMLSonline.com can help you sell your Minnesota home today.