Many first-time homebuyers fall prey to common myths that complicate what’s already a daunting journey. Imagine having a compass in this maze; TheMLSonline stands as just that for navigating the intricate process of homebuying with unparalleled expertise. Isn’t that good news?

In Saint Paul, MN, where every neighborhood has its own unique charm and challenges, expert guidance isn’t just helpful—it’s essential. Join us as we demystify those pervasive homebuying myths, ensuring you step into the market not only with dreams but also with confidence and clarity.

Understanding Homebuying Myths

Common Misconceptions

Many people believe you need a significant down payment to buy a home. This isn’t always true. Various programs allow for lower down payments, especially for first-time buyers.

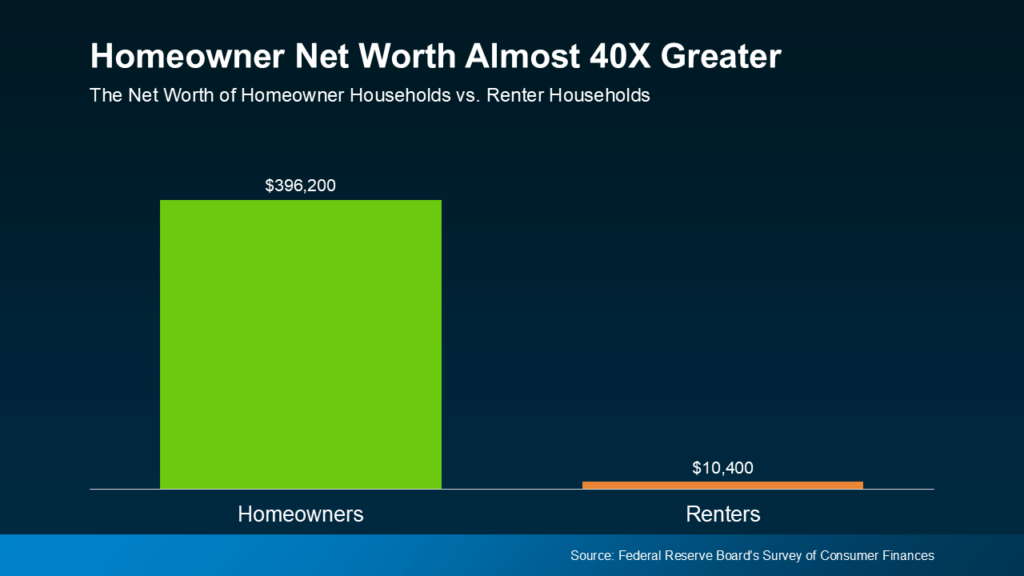

Another myth is that renting always throws money away. Renting can offer flexibility and less financial burden in certain situations. It’s not just about the money spent, but what suits your lifestyle at the moment.

Lastly, the idea that you can’t buy a home with bad credit is misleading. While having good credit helps, there are options like FHA loans designed for those with less-than-perfect credit scores.

Truth vs. Fiction

A common misunderstanding is that pre-approval means a guaranteed mortgage offer. In reality, it’s an initial assessment rather than a firm commitment from lenders.

People often think online home values are accurate reflections of market value. However, these estimates can vary significantly from actual appraisals due to local market dynamics and property conditions.

The belief that you must have permanent employment to qualify for a mortgage in Saint Paul, MN, ignores other income sources lenders consider valid, such as freelance work or consistent part-time jobs.

Impact on Buyers

Believing myths can delay your homebuying process by making you think you’re not ready when you might be.

Myths increase anxiety around affordability and loan approval chances.

Misconceptions lead potential buyers in Saint Paul, MN, to overlook viable properties within their reach because they don’t meet perceived requirements.

Down Payment Myths

Real Requirements

Many believe a large down payment is mandatory to buy a home. This isn’t always true. Minimum down payments vary by loan type.

Income stability often holds more weight than the job itself in Saint Paul, MN. Lenders look for consistent income over time rather than high-paying but erratic jobs.

The debt-to-income ratio plays a pivotal role, too. It measures your ability to manage monthly payments and debts efficiently. A lower ratio means better chances of approval.

Saving Strategies

Saving for a down payment might seem daunting at first glance, but it’s doable with the right strategies.

Automating savings can ensure you consistently set aside money for your home without thinking about it each month.

Reviewing monthly expenses reveals unnecessary subscriptions or costs that could be cut back on or eliminated altogether to boost savings efforts.

Considering side hustles specifically aimed at increasing your home savings fund can accelerate progress toward reaching your goal.

Mortgage Myths

When dealing with personal finance, few topics elicit as much confusion and misinformation as mortgages. Among the various types of mortgage products available, fixed-rate mortgages stand as a cornerstone of stability and predictability in the housing market.

Lender Misconceptions

Many believe all lenders in Saint Paul, MN, offer the same rates and terms. This is false. Rates and terms vary widely. Shopping around can save you thousands.

Prequalification does not equal a loan commitment. It’s merely an assessment of your borrowing power, not a guarantee.

Switching lenders doesn’t always reset your mortgage process in Saint Paul, MN. While it may cause some delays, it won’t take you back to square one.

Interest Rate Truths

Interest rates change daily and differ by lender. It’s crucial to compare offers. Locking in a rate shields you from future increases during the mortgage process.

However, lower rates often mean higher fees. When considering various types of mortgages for purposes such as home purchase, investment, or life circumstances, borrowers should carefully evaluate the trade-offs between interest rates and associated fees.

Student Loans Impact

Credit Score Myths

A perfect credit score isn’t needed for the best rates in Saint Paul, MN. Lenders consider various factors.

Checking your credit doesn’t always hurt your score if done wisely as part of loan shopping.

Past bankruptcies don’t disqualify you forever from buying a home. Many can qualify for mortgages after meeting certain conditions post-bankruptcy, even if they have student loan debt.

Professional Inspections

Importance

Busting homebuying myths is crucial. It saves both money and time. Knowing the truth helps buyers negotiate better deals. It also prepares them financially.

Professionals play a key role here. They provide accurate information. This information guides buyers through complex decisions.

Misconceptions

Several myths confuse buyers in Saint Paul, MN.

First, many think mortgage interest is their biggest expense. But other costs can add up, too. Think of property taxes and maintenance fees.

Second, there’s a myth that new homes are pricier than older ones. This isn’t always true.

- New homes may have modern features but come with hidden costs.

- Older homes might need repairs but offer charm and lower prices.

Lastly, some believe they can’t negotiate closing costs.

- In reality, everything is negotiable.

- Buyers should ask professionals for help to understand what can be reduced or waived.

Mortgage Application Realities

Multiple Applications

Contrary to popular belief, shopping around for a mortgage doesn’t significantly harm your credit score. This myth can deter homebuyers in Saint Paul, MN, from exploring their options. In reality, credit bureaus expect you to shop around and typically treat multiple applications within a short period of time as a single inquiry.

The first loan offer isn’t always the best one. It’s crucial to compare offers because terms and rates vary between lenders. The fear of multiple rejections shouldn’t stop you from seeking the best deal, either. Each lender has different criteria, and what leads to rejection at one institution could be acceptable at another.

Choosing Lenders

The assumption that big banks offer the best mortgage deals isn’t always true. While they have a wide range of products, their rates aren’t automatically lower than those offered by other lenders.

Additionally, many lenders provide payment assistance programs and offer helpful resources to assist borrowers, which may not be as readily available through larger institutions. Exploring various publications and resources can help borrowers make informed decisions when selecting a mortgage provider.

Online lenders are often thought to lack personalized service compared to local banks in Saint Paul, MN. However, many online platforms provide exceptional customer support and customized advice through digital tools and direct communication channels.

Credit unions are mistakenly believed not to offer competitive mortgage rates in this region. Yet, they frequently provide lower rates than their counterparts due to their member-focused policies.

Closing Costs Clarified

Upfront Costs Truth

Many believe that closing costs are set in stone. This isn’t always true. Sometimes, these costs can be rolled into your loan amount. This means you won’t have to pay them upfront.

Not every cost at closing is mandatory. Some fees, like inspection and appraisal charges, can be negotiated or even waived entirely. It’s important to remember that fees for inspections and appraisals vary greatly in Saint Paul, MN. They depend on the property’s size and location.

Down Payment Fallacy

A common myth is that a larger down payment always eliminates mortgage insurance in Saint Paul, MN. However, this only applies to traditional mortgages.

For many homebuyers in Saint Paul, MN, it’s believed only traditional mortgages accept lower down payments. That’s not accurate. Gifts or grants for down payments are often seen as red flags by lenders. Yet they’re widely accepted under certain conditions.

Unlock Success Together: Partnering with TheMLSonline to Demystify Homebuying Myths!

Expert Perspective

Our team at TheMLSonline brings a wealth of knowledge to the table. We understand that navigating homebuying myths can be tricky. That’s why we’re here.

We start by identifying common misconceptions our clients in Saint Paul, MN, might have. For example, many believe they need a perfect credit score to buy a house. Not true! We explain how different factors affect loan approval. Our experts also tackle myths about down payments and closing costs, ensuring you have the full picture.

Empowering Buyers

Knowledge is power, especially in real estate. Our approach focuses on empowering buyers with accurate information.

We provide resources and tools that help demystify the process. This includes detailed guides on every step of buying a home in Saint Paul, from searching listings to making an offer. By understanding what’s a myth and what’s a fact, our clients make informed decisions confidently.

Proven Track Record

TheMLSonline has helped countless individuals and families achieve their dream of homeownership in Saint Paul.

Our success stories speak volumes about our ability to guide clients through complex processes smoothly. From debunking myths about fixer-uppers being always cheaper to clarifying misconceptions around closing costs earlier, we ensure every client’s journey is based on truth and transparency.

Unraveling Homebuying Myths and Embracing Effective Tips for a Seamless Experience

Navigating the homebuying process can feel like trekking through a maze blindfolded, especially with all those pesky myths clouding your vision. You’ve seen how down payment fables, mortgage misconceptions, and inspection inaccuracies can throw you off course.

But hey, knowledge is your power-up here. By debunking these myths and grasping the realities of mortgage applications and closing costs, you’re not just walking blindly anymore; you’re striding confidently toward your dream home. And remember, you’re not alone in this journey.

Ready to bust more myths and make that dream home a reality? Reach out to TheMLSonline today. Let’s unlock the door to your future home together, myth-free and full of confidence. Let’s get moving—your dream home awaits!